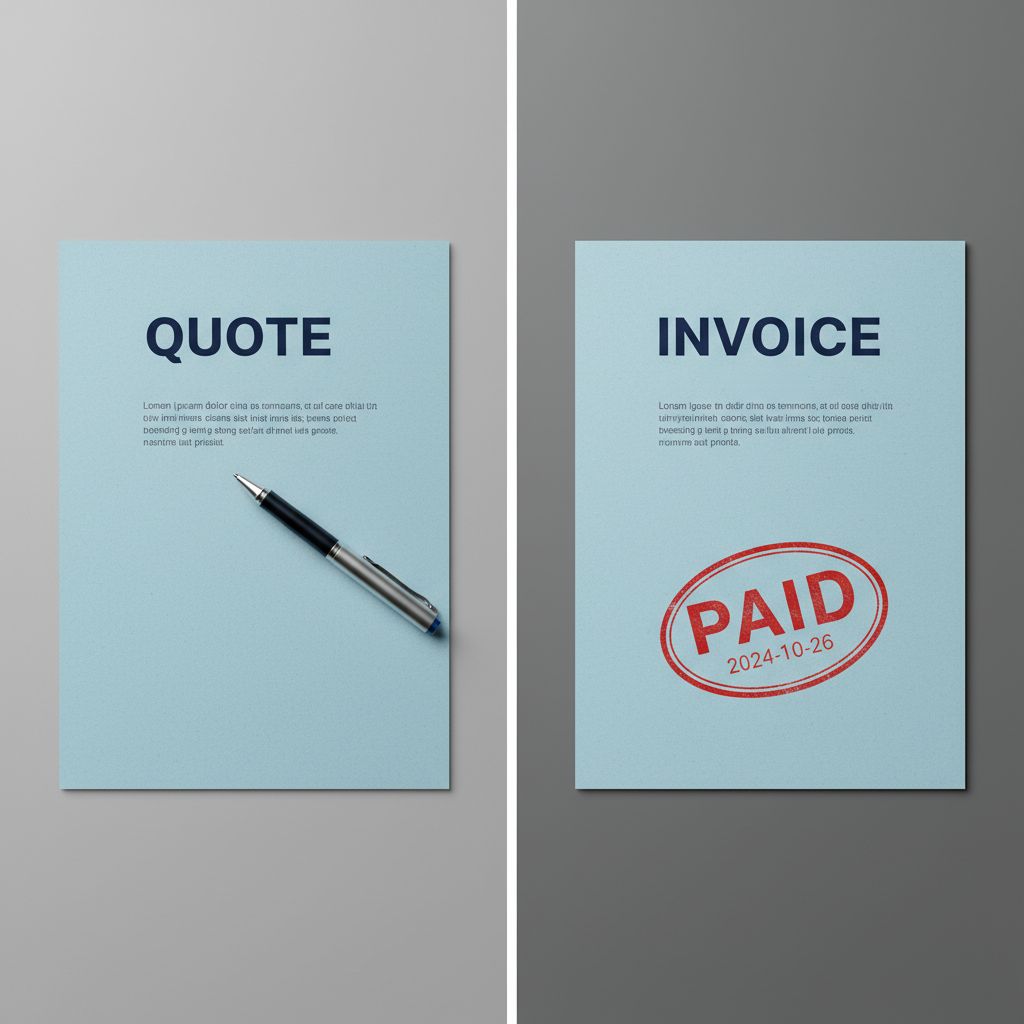

Quote vs Invoice: Understanding the Key Differences

Learn the essential differences between quotes and invoices, when to use each document, and how to convert quotes to invoices effectively.

Quote vs Invoice: Understanding the Key Differences

When running a business, especially as a freelancer or service provider, you'll regularly work with two important documents: quotes and invoices. While they might seem similar at first glance, understanding the difference between a quote and an invoice is crucial for proper business operations, cash flow management, and maintaining professional relationships with clients.

What is a Quote?

A quote (also known as a quotation or estimate) is a document you provide to a potential client before you start work. It's essentially a formal proposal that outlines:

- The services or products you'll provide

- The estimated cost for each item

- The total estimated price

- Terms and conditions

- Validity period (how long the quote remains valid)

Think of a quote as a promise—you're telling the client "if you hire me, this is what I'll do and approximately how much it will cost."

Key Characteristics of Quotes:

- Pre-work document - Created before any services are rendered

- Non-binding estimate - The actual cost may vary

- Validity period - Usually valid for 30-90 days

- No payment due - Simply a proposal, not a request for payment

- Subject to change - Can be revised if scope changes

What is an Invoice?

An invoice is a document you send to a client after you've completed work or delivered products. It's a formal request for payment that includes:

- A detailed list of completed services or delivered products

- Exact quantities and prices

- The total amount due

- Payment terms and due date

- Instructions for how to pay

An invoice is a bill—you're saying "I've completed the work, now please pay me this amount."

Key Characteristics of Invoices:

- Post-work document - Created after services are completed

- Binding request - Represents actual work done and payment owed

- Payment due date - Client must pay by a specific date

- Legal document - Can be used for accounting and tax purposes

- Non-negotiable - Reflects actual work completed

Key Differences at a Glance

| Feature | Quote | Invoice |

|---|---|---|

| Timing | Before work begins | After work is completed |

| Purpose | Proposal/Estimate | Payment request |

| Binding | Non-binding estimate | Binding payment obligation |

| Payment | No payment requested | Payment required |

| Flexibility | Can change | Fixed (reflects actual work) |

| Validity | Has expiration date | No expiration (until paid) |

| Status | "Here's what I can do" | "Here's what I did, please pay" |

When to Use a Quote

Use a quote when:

- A client requests pricing information - They want to know how much your services will cost before committing

- Competitive bidding - Multiple providers are competing for the same project

- Complex projects - The work scope might vary, so you need to provide an estimate first

- Custom work - The project is unique and requires specific pricing

- New client relationships - Establishing trust by showing transparency in pricing

Quote Best Practices:

- Be specific - Include detailed breakdowns of services

- Include validity period - State how long the quote is valid (typically 30-90 days)

- Set clear terms - Outline payment terms that will apply if accepted

- Include scope boundaries - Clearly define what is and isn't included

- Add contingencies - Note any factors that might affect pricing

When to Use an Invoice

Use an invoice when:

- Work is completed - You've finished the services or delivered the products

- Payment is due - It's time to request payment from the client

- Milestone reached - For long projects, invoice at agreed milestones

- Recurring billing - Monthly retainer or subscription services

- Legal record - You need documentation for accounting or tax purposes

Invoice Best Practices:

- Invoice promptly - Send invoices immediately after completing work

- Include all details - List all services/products with exact quantities and prices

- Set clear due dates - Specify when payment is expected (e.g., Net 30)

- Provide payment options - Include multiple ways to pay (bank transfer, credit card, etc.)

- Follow up - Send reminders if payment becomes overdue

The Quote-to-Invoice Process

The typical workflow looks like this:

- Client requests services - Client asks for pricing or proposal

- You create a quote - Send a detailed quote with estimated costs

- Client accepts quote - Client approves the quote (verbally or in writing)

- You complete the work - Perform the services as outlined

- You create an invoice - Send invoice based on actual work completed

- Client pays invoice - Payment is received

Converting a Quote to an Invoice

When converting a quote to an invoice, ensure that:

- Final prices match - If the actual work differs, adjust pricing accordingly

- Include all completed work - Add any additional services performed

- Remove estimate language - Change "estimated cost" to "total due"

- Add payment terms - Include payment due date and instructions

- Reference the quote - Note the original quote number for reference

💡 Quick Tip: Have an existing quote document? Use our AI-powered Quote to Invoice Converter to automatically extract all the details and convert it to an invoice in seconds. Simply upload your quote (PDF or image), and our tool will extract company information, line items, dates, and all other details automatically.

Common Scenarios and Which to Use

Scenario 1: First-Time Client Consultation

Use a Quote: When a potential client asks "How much would this project cost?"

You need to provide an estimate before they commit to hiring you.

Scenario 2: Completed Web Design Project

Use an Invoice: After you've finished designing and developing the website.

You've completed the work, now you need to get paid.

Scenario 3: Ongoing Monthly Services

Use Invoices Monthly: For retainer clients or subscription services.

Each month, send an invoice for that month's services.

Scenario 4: Complex Project with Milestones

Use Quote First, Then Multiple Invoices: Start with a quote, then invoice at each milestone.

This provides upfront clarity and regular payment points.

Legal and Accounting Considerations

Quotes

- Not legally binding - Generally, quotes are estimates and can be revised

- Acceptance creates contract - Once a client accepts a quote, it can form a binding agreement

- Validity matters - Expired quotes may not be enforceable

- Scope protection - Well-written quotes protect you from scope creep

Invoices

- Legal documents - Create a legal obligation for payment

- Tax records - Important for accounting and tax filing

- Debt collection - Can be used to pursue unpaid debts

- Business records - Part of your official business documentation

Best Practices for Both Documents

Design and Presentation

- Professional appearance - Both should look polished and trustworthy

- Clear branding - Include your logo and business information

- Easy to read - Use clear formatting and organized layouts

- Consistent style - Maintain consistent design across all documents

Content and Clarity

- Detailed descriptions - Be specific about what's included

- Clear pricing - Break down costs transparently

- Terms and conditions - Include payment terms, cancellation policies, etc.

- Contact information - Make it easy for clients to reach you

Digital Tools

Using professional invoicing software helps you:

- Create professional quotes and invoices quickly

- Track which quotes convert to invoices

- Manage payment status

- Generate reports for accounting

- Send automatic reminders

Ready to convert a quote to an invoice? Try our free Quote to Invoice Converter - upload your quote file and we'll extract all the details automatically using AI vision technology.

Browse our quote templates and invoice templates to get started.

Common Mistakes to Avoid

With Quotes:

- Making them too vague - Leads to misunderstandings and scope creep

- No expiration date - Can cause issues if quoted prices become outdated

- Underestimating - Better to slightly overestimate than to lose money

- Forgetting to get approval - Always get written or verbal acceptance

With Invoices:

- Delayed invoicing - Send invoices immediately after completing work

- Unclear payment terms - Clients need to know when and how to pay

- Missing details - Incomplete invoices slow down payment

- Not following up - Be proactive about collecting payments

The Bottom Line

Understanding the difference between quotes and invoices is fundamental to running a successful business:

- Quotes are your sales tool—they help you win clients by showing what you'll do and how much it costs

- Invoices are your payment tool—they ensure you get paid for the work you've completed

Both documents are essential parts of the client relationship lifecycle. By using them correctly and professionally, you'll:

- Build trust with potential clients (through clear quotes)

- Get paid faster (through prompt, clear invoices)

- Maintain better business records

- Reduce disputes and misunderstandings

- Improve cash flow

Related Guides

- What is a Quote in Business? - Comprehensive guide to quotes

- How to Write a Quote for a Job - Step-by-step guide

- What is an Invoice? - Comprehensive guide to invoices

- How to Write an Invoice - Step-by-step guide

- Invoice vs Quote vs Contract - Understanding all three documents

- Quote vs Estimate - Understanding the differences

Whether you're creating your first quote or sending your hundredth invoice, using professional tools and following best practices will make your business operations smoother and more successful.

Ready to create professional quotes and invoices? Explore our templates to find the perfect solution for your business needs.